Back-to-back presentations in council chambers Monday morning painted a stark picture of a Seattle divided between the homeowning haves and the renting have-nots, and also showed once again with data (not the ever-popular anecdotes) that the tighter the supply of any form of housing, rented or owner-occupied, the more expensive that housing is.

First, the good news: For renters, a development boom over the last few years is already starting to relieve pressure on prices, meaning that rents are likely to go down or at least stabilize as vacancies go up. Mike Scott of Dupre+Scott, a longtime Seattle apartment market analyst, likened the development pipeline as “a snake eating a small animal—it’s going to digest it, but it’s going to take some time.”

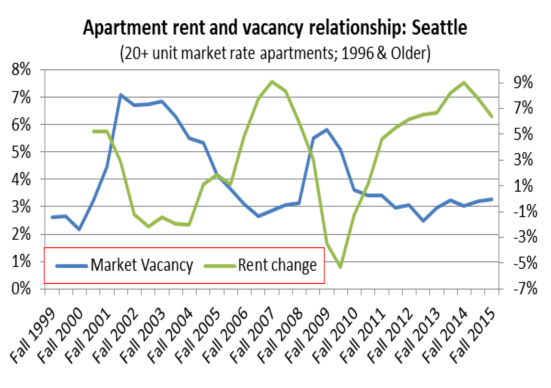

The relationship between supply and demand—or, put another way, vacancies and rents—is starkly illustrated in the following graph, which shows that as supply tightens (that is, as development slows down), rents go up; as more housing gets built, rents decline.

That’s true, Scott pointed out, even though new apartments are usually more expensive to rent than existing stock. (The Housing Affordability and Livability Agenda, which proposes to build 50,000 new units over the next decade, including 20,000 affordable units, would make a dent in the need but would not by itself accommodate the 120,000 people expected to move to Seattle by 2035).

The exception to that rule was microhousing, small efficiency units that are expensive per square foot but affordable in practice; according to Scott’s presentation, the average microunit rented for $871 in 2015, compared to an average studio rent of $1,433. Unfortunately, city regulations have effectively banned the development of new microhousing, and that housing type has been replaced by so-called small efficiency dwelling units, or SEDUs (which Scott insisted on pronouncing, “Said-Yous”). Those are still cheaper than studios, but significantly more expensive than micros, at an average of $1,151 a month.

None of those rents are particularly affordable to struggling working-class or middle-class renters, of course, and the solutions seem obvious: More housing, and more opportunities for homeownership. Unfortunately, city rules that reserve nearly two-thirds of the land in Seattle for single-family homeowners make it extremely difficult to build the massive quantity of new housing stock the city would need to significantly push rents down, and first-time homeownership, as a presentation by Zillow’s chief economist Svenja Gudell illuminated, is elusive to all but the wealthiest and becoming more so. In January, single-family home values were up 11.8 percent over last year, and condos were up 14.2 percent. “That’s very, very strong—much stronger than you would see in a normal year,” Gudell said. The average home in Seattle was valued at $533,000, making this the definition of a seller’s market as long as you don’t want to buy another home in Seattle.

None of those rents are particularly affordable to struggling working-class or middle-class renters, of course, and the solutions seem obvious: More housing, and more opportunities for homeownership. Unfortunately, city rules that reserve nearly two-thirds of the land in Seattle for single-family homeowners make it extremely difficult to build the massive quantity of new housing stock the city would need to significantly push rents down, and first-time homeownership, as a presentation by Zillow’s chief economist Svenja Gudell illuminated, is elusive to all but the wealthiest and becoming more so. In January, single-family home values were up 11.8 percent over last year, and condos were up 14.2 percent. “That’s very, very strong—much stronger than you would see in a normal year,” Gudell said. The average home in Seattle was valued at $533,000, making this the definition of a seller’s market as long as you don’t want to buy another home in Seattle.

As for first-time buyers, they’re being buffeted by a near-perfect storm: High rents that make it difficult to save money for a down payment; a high-demand market where lenders can afford to be selective about who they loan to; lending standards that have tightened in general since a recession caused largely by banks loaning money to people with bad credit; and the simple fact that there just aren’t many houses, condos, and townhomes on the market to begin with.

“Rents are extremely high, so it’s still hard to save for that downpayment, and if you’ve qualified, it’s quite difficult to find anything at all, because affordable housing at all price points is in very tight supply right now,” Gudell said.

How tight? Here’s an unsettling stat to ponder as you write your next rent check: Right now, there are only 906 homes of any kind for sale in Seattle—a 21 percent drop from last year. So while buying a home is currently much more affordable than renting one (as the graph from Zillow, below, illustrates), it’s out of reach to all but a few. One reason for that is the fact that there are still a significant number of homeowners (about 7 percent) whose homes are underwater, meaning they owe more than the value of their condo or house. Those people, according to Gudell, tend to be lower-income owners of lower-price houses, and they aren’t selling, which means that what would be entry-level homes are simply off the market.

Actually, pretty much all homes are off the market. Another reason for that: People who want to stay in Seattle don’t really benefit from elevated home prices, because they have to turn around and buy another house in the same overinflated market. “Seattle is a distinct seller’s market right now—as a seller you definitely have the upper hand and have more power in that negotiation compared to the buyer—but most sellers turn around and become buyers and they can’t find house they want to buy.”

The moral, for both renters and buyers? Hang tight and hope* Organize and demand that the city allow more density, which will reduce rents, and wait for the next downturn to roll around.

*Mike in the comments makes an excellent argument for this edit.

Foreign investment, “dark housing” (where investors buy up property and sit on it, rather than rent it, while it appreciates), and speculation by “flippers” drive up the costs. Every time a property sees a stepped-up value makes the City less affordable. This has nothing to do with single family zoning, which the Mayor has chosen to attack as racist and exclusionary (the big bully!).

Our Residential Urban Village has tons of capacity under existing zoning to handle new development, but the market has determined, for whatever reason, that the NC property owners do not want to build here. They figure if they wait long enough, much like dark housing, they will be able to build bigger, even though building now, under current zoning, would help immensely.

I became a HALA skeptic as soon as I heard that they were hanging their hat on their “fact” that 65% of Seattle was zoned single family, but in reality that the area they used included roads, parks, and lakes… Yes, Discovery Park, Seward Park, Sand Point, even the surface of Green Lake was included as developable property. Why, I asked myself, did the City feel compelled to base their rationale on fake data? What other “facts” we’re cooked in the report?

Be skeptical. Current property owners share the same concerns about affordability. We have all been there, trying to scrape together money to own. Do not allow the Mayor to turn this into a “renters vs. owners” campaign. We need more, smaller starter properties, which are the first to go, gobbled up by speculators, when our neighborhoods are opened up for rampant access by some of the strategies in HALA. Do your research!

You’re absolutely right, Gregf. Seattle has decided it wants to be a “global City.” It seems as though growth this developer-led building boom is being driven by this mind-less goal. How can we say this growth is for jobs when so many of the high tech jobs being produced are being filled by people who are coming here — because it’s cheaper to live in Seattle than San Francisco? As long as there are so many high paid workers, developers and landlords can get the prices they want; they have no incentive to charge anything less. Seattle leaders sponsor this growth through tax incentives for prosperous companies like Vulcan and then do little or nothing to mitigate the consequences. They are also producing gentrification in what used to be lower and middle class neighborhoods.

What don’t city planners move out of the 20th century and into some 21st century housing alternatives — like more tax incentives for co-housing and Community Land Trusts? Why don’t they support local builders instead of NY and Chinese investors? You can’t build your way out of this situation as long as it is being driven by city policies that promote growth led by and for developers. Hala needs to start considering other strategies, especially in a city where almost 60% of residents live alone. That alone is a waste of resources. BTW, from my research it is not uncommon for cities the size of Seattle to be over 70% single family zoning. Quit sponsoring the developers and come up with some more creative solutions, HALA!

We are hoping there will be some money for Community Land Trusts in the Housing Levy if that passes.

“Unfortunately, city rules that reserve nearly two-thirds of the land in Seattle for single-family homeowners make it extremely difficult to build the massive quantity of new housing stock the city would need to significantly push rents down,”

One, new developments tend to be more expensive (you mentioned this yourself). Two, the supply and demand argument might work if Seattle lived in a bubble. But it does not. If you incentivize building to make it very profitable, which it currently is, then you get investors from outside of Seattle who buy up properties (decreasing supply) as an investment to to turn into luxury apartments which increases prices. I think the argument could actually be made that this boom in development is the cause of our affordability crisis and not the solution. As we build more luxury apartments, along with frequent flight between here and China, we can be very attractive for the Chinese tech company who wants to build an office on the west coast. We are still cheaper than San Francisco. The argument that more dense cities are cheaper cities simply does not hold up. Usually it is the opposite and it is because these cities do not exist in a bubble. Build it and more people will come.

“city rules that reserve nearly two-thirds of the land in Seattle for single-family homeowners”

The city has said that 65% of Seattle is single family zoned but this is misleading, since in the calculation they also included non-developable land such as parks, schools & roads. The number if you only figure in actual developable land is closer to 50%.

The graft and this statement are also misleading:

“The following graph, which shows that as supply tightens (that is, as development slows down), rents go up; as more housing gets built, rents decline. That’s true, Scott pointed out, even though new apartments are usually more expensive to rent than existing stock.”

I would instead like to see rent prices, not percent increase or decrease considering new apartments are more expensive. If the prices start higher then a percent decrease does not mean as much.

This statement is misleading:

“The Housing Affordability and Livability Agenda, which proposes to build 50,000 new units over the next decade, including 20,000 affordable units, would make a dent in the need but would not by itself accommodate the 120,000 people expected to move to Seattle by 2035.”

It is estimated that the population of Seattle will grow by 120,000 people by 2035. It is estimated that we will need 70,000 housing units to house these people. So in 20 years we will need 70,000 housing units. Mayor Murray wants to “front load” (the words of his staff) this demand by building 50,000 units in the first 10 years. Then we would theoretically only need an additional 20,000 units for the second 10 years to get us to 70,000 units for 2035. See the Seattle 2035 Development Capacity Report: http://www.seattle.gov/dpd/cs/groups/pan/@pan/documents/web_informational/p2182731.pdf

You are talking about 50,000 housing units in 10 years vs 120,000 people (70,000 housing units) in 20 years, please also keep in mind that many housing units house more than one person.

H

This was an excellent review and equally excellent solution before the edit.

I would like to note, that the Magnolia Community Council approval a letter we send to Council supporting the Mayor’s first HALA ordinance that allows for more density in Magnolia with taller buildings that include subsidized below market units. Working together is how we build more housing. Making demands will just create fights while slowing down progress.

Anyway, this was a very well crafted review of housing needs. Thank You.

Test

I am so glad that you are blogging about this issue. It’s scary how high rent prices are, and I guess for whatever reason I never thought to connect the price to the fact that cities have these absurd regulations! Thank you for sharing all this information. This helps us know where we should be putting pressure 🙂

“Hang tight and hope the city allows more density”

No. Demand the city to start allowing more density. The renters of this city could change the rules tomorrow if they found their voice and all worked together. Renters are a popular majority in this city, but likely a voting minority.

The City is in the process to allow more density. Proposed Urban Village expansions and upzones within village boundaries will add development capacity. Couple that with the 224K additional units already allowed under current zoning (per City’s Development Capacity Report, Sept. 2014).