1. The Seattle City Council voted not to overturn Mayor Bruce Harrell’s veto of legislation that would have directed a research university, such as the University of Washington, to collect information from landlords about the size of their units and how much they charge. City  Councilmember Alex Pedersen sponsored the proposal because, he said at Tuesday’s meeting, it would help the city “validate [the] affordable benefits of smaller mom and pop landlords,” informing the city’s upcoming Comprehensive Plan rewrite; Councilmember Tammy Morales (District 2) co-sponsored it because she said it would give renters better information to make housing decisions and could ultimately bolster support for rent control.

Councilmember Alex Pedersen sponsored the proposal because, he said at Tuesday’s meeting, it would help the city “validate [the] affordable benefits of smaller mom and pop landlords,” informing the city’s upcoming Comprehensive Plan rewrite; Councilmember Tammy Morales (District 2) co-sponsored it because she said it would give renters better information to make housing decisions and could ultimately bolster support for rent control.

“This could mean, for tenants, that they finally have the ability to make an informed decision and to make a choice between units when they’re searching for a new home—something that landlords have been able to do with background checks on tenants for decades,” Morales said. “We would finally have concrete data that dispels the illusion that private-market, trickle-down economics is the solution to our affordability crisis.”

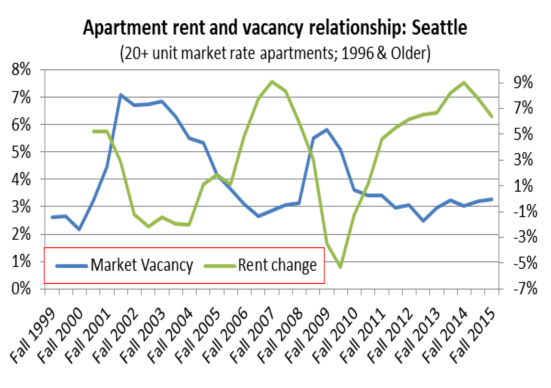

Renters, unlike homeowners, lack access to crucial information to help them make informed housing decision. While home buyers can easily access public information about what a house sold for most recently, the assessed value of adjacent and nearby houses, and (through data maintained and published by the Multiple Listing Service) the average prices of houses in a particular area, renters have to rely on sites like Apartment Finder and Craigslist to get a general idea of local rents. Searches for the “median rent” in Seattle yield numbers that vary by hundreds of dollars, making it impossible to know whether the rent a landlord is charging is reasonable.

In vetoing the legislation, Harrell argued that the bill would violate landlords’ rights by revealing “proprietary” information.

Overturning a mayoral veto requires a minimum of six council votes; as in the original vote, just five councilmembers supported the legislation this time.

2. JustCare, the COVID-era program that engaged with people living in encampments and moved them into hotel-based shelter, will no longer continue in its previous form. The program, run by the Public Defender Association, ran out of city funding at the end of June. Its new iteration, which will focus exclusively on encampments in state-owned rights-of-way, will be funded using state dollars allocated in a supplemental state budget for shelter and services tied to encampment removals on state-owned property.

“In the sense of a response to the conditions in the specific neighborhoods we served, there is no more JustCare. That era is over – it’s been superseded. The City of Seattle and KCRHA are now in charge of that response.”—Lisa Daugaard, Public Defender Association

The funding is only available to groups that focus on encampments in sites “identified by the department of transportation as a location where individuals residing on the public right-of-way are in specific circumstances or physical locations that expose them to especially or imminently unsafe conditions, including but not limited to active construction zones and risks of landslides.”

By moving its focus to encampments in state rights-of-way, such as highway overpasses, JustCare will lose its geographic, neighborhood-based focus, PDA co-director Daugaard acknowledges.

“In the sense of a response to the conditions in the specific neighborhoods we served, there is no more JustCare,” Daugaard said. “That era is over – it’s been superseded. The City of Seattle and KCRHA are now in charge of that response.” Continue reading “Harrell Veto of Rent Transparency Bill Stands, JustCare Will Transition to Focus on Highway Encampments”